Tax Return For Investment Income . net investment income is income received from assets (before taxes) including bonds, stocks, mutual funds, loans, and. guidance and forms for tax on savings and investments. Including savings interest, savings for children, tax on. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. how to fill in your tax return (2022) updated 8 april 2024. You’ll need a digital identification certificate to file. you can file income tax returns online at the tax authority’s website. how much tax you pay on your investment capital and income in spain is determined by your circumstances and the structure of your assets. These notes will help you to fill in your paper tax return.

from ultimateestateplanner.com

Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. These notes will help you to fill in your paper tax return. You’ll need a digital identification certificate to file. guidance and forms for tax on savings and investments. net investment income is income received from assets (before taxes) including bonds, stocks, mutual funds, loans, and. you can file income tax returns online at the tax authority’s website. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. how much tax you pay on your investment capital and income in spain is determined by your circumstances and the structure of your assets. Including savings interest, savings for children, tax on. how to fill in your tax return (2022) updated 8 april 2024.

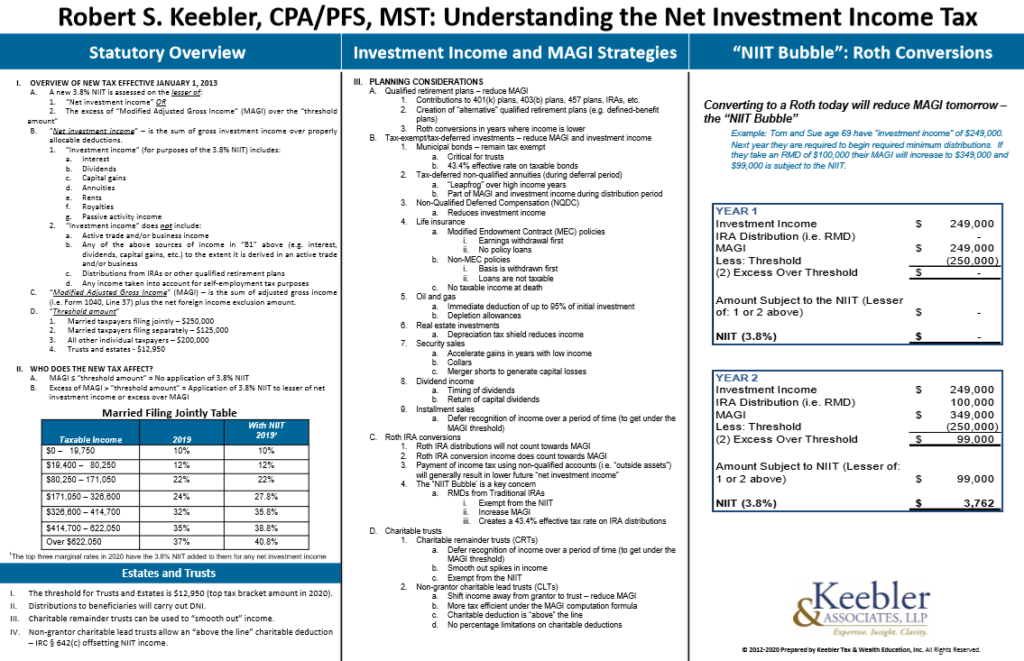

2024 Understanding the Net Investment Tax Chart Ultimate

Tax Return For Investment Income Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. net investment income is income received from assets (before taxes) including bonds, stocks, mutual funds, loans, and. Including savings interest, savings for children, tax on. how much tax you pay on your investment capital and income in spain is determined by your circumstances and the structure of your assets. you can file income tax returns online at the tax authority’s website. how to fill in your tax return (2022) updated 8 april 2024. Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. These notes will help you to fill in your paper tax return. guidance and forms for tax on savings and investments. You’ll need a digital identification certificate to file.

From freshplan.ca

Taxes and Investment Fresh Plan Tax Return For Investment Income Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. You’ll need a digital identification certificate to file. Including savings interest, savings for children, tax on. how to fill in your tax return (2022) updated 8 april 2024. These notes will help you to fill in your paper tax. Tax Return For Investment Income.

From www.personalfinanceplan.in

How is Interest from your Investments taxed? Personal Finance Plan Tax Return For Investment Income These notes will help you to fill in your paper tax return. you can file income tax returns online at the tax authority’s website. Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. how much tax you pay on your investment capital and income in spain is. Tax Return For Investment Income.

From www.teachmepersonalfinance.com

IRS Form 15111 Instructions Earned Credit Worksheet Tax Return For Investment Income how much tax you pay on your investment capital and income in spain is determined by your circumstances and the structure of your assets. how to fill in your tax return (2022) updated 8 april 2024. guidance and forms for tax on savings and investments. These notes will help you to fill in your paper tax return.. Tax Return For Investment Income.

From russellinvestments.com

How Can State Taxes Impact Investments? Russell Investments Tax Return For Investment Income You’ll need a digital identification certificate to file. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. guidance and forms for tax on savings and investments. Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. how. Tax Return For Investment Income.

From www.benefitspro.com

10 investment tax questions, answered BenefitsPRO Tax Return For Investment Income Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. Including savings interest, savings for children, tax on. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. how to fill in your tax return (2022) updated 8 april. Tax Return For Investment Income.

From mrgwealth.com

Investment & Taxes MRG Wealth Management Tax Return For Investment Income You’ll need a digital identification certificate to file. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. guidance and forms for tax on savings and investments. These notes will help you to fill in your paper tax return. how to fill in your tax return (2022) updated. Tax Return For Investment Income.

From www.slideserve.com

PPT Return on Investment (ROI) Formula PowerPoint Presentation, free Tax Return For Investment Income net investment income is income received from assets (before taxes) including bonds, stocks, mutual funds, loans, and. Including savings interest, savings for children, tax on. Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. it includes information on the tax treatment of investment income and expenses for. Tax Return For Investment Income.

From www.investopedia.com

Investment Definition Tax Return For Investment Income it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. you can file income tax returns online at the tax authority’s website. Including savings interest, savings for children, tax on. net investment income is income received from assets (before taxes) including bonds, stocks, mutual funds, loans, and. These. Tax Return For Investment Income.

From www.financestrategists.com

Tax Planning for Investments Definition, Strategies, and Types Tax Return For Investment Income how much tax you pay on your investment capital and income in spain is determined by your circumstances and the structure of your assets. You’ll need a digital identification certificate to file. Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. guidance and forms for tax on. Tax Return For Investment Income.

From crixeo.com

What You Need To Know About TaxEfficient Investing For Beginners Crixeo Tax Return For Investment Income These notes will help you to fill in your paper tax return. you can file income tax returns online at the tax authority’s website. Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. Including savings interest, savings for children, tax on. it includes information on the tax. Tax Return For Investment Income.

From blog.sprintax.com

How to add investment in Sprintax when filing a tax return Tax Return For Investment Income guidance and forms for tax on savings and investments. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. net investment income is income received from assets (before taxes) including bonds, stocks, mutual funds, loans, and. how to fill in your tax return (2022) updated 8 april. Tax Return For Investment Income.

From www.financialexpress.com

Salaried employee? These payments, investments and will give Tax Return For Investment Income Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. These notes will help you to fill in your paper tax return. guidance and forms for tax on savings and investments. how much tax you pay on your investment capital and income in spain is determined by your. Tax Return For Investment Income.

From www.livemint.com

How much tax do you pay on your investments? Livemint Tax Return For Investment Income You’ll need a digital identification certificate to file. you can file income tax returns online at the tax authority’s website. how to fill in your tax return (2022) updated 8 april 2024. These notes will help you to fill in your paper tax return. Here, we break down some of the important considerations that affect your financial situation. Tax Return For Investment Income.

From aristotleconsultancy.com

Investment & Tax Planning Strategies for Wealth Growth Unlock Tax Return For Investment Income you can file income tax returns online at the tax authority’s website. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. guidance and forms for tax on savings and investments. how to fill in your tax return (2022) updated 8 april 2024. how much tax. Tax Return For Investment Income.

From wallethacks.com

Net Investment Tax What It Is and How to Avoid It Best Wallet Tax Return For Investment Income Here, we break down some of the important considerations that affect your financial situation as an expatriate living in spain. These notes will help you to fill in your paper tax return. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. you can file income tax returns online. Tax Return For Investment Income.

From www.relakhs.com

Tax Declaration & List of Investment Proofs (FY 202021) Tax Return For Investment Income net investment income is income received from assets (before taxes) including bonds, stocks, mutual funds, loans, and. how much tax you pay on your investment capital and income in spain is determined by your circumstances and the structure of your assets. Including savings interest, savings for children, tax on. it includes information on the tax treatment of. Tax Return For Investment Income.

From www.livemint.com

How much tax do you pay on your equity investment Tax Return For Investment Income These notes will help you to fill in your paper tax return. it includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or. guidance and forms for tax on savings and investments. you can file income tax returns online at the tax authority’s website. You’ll need a digital identification. Tax Return For Investment Income.

From ultimateestateplanner.com

2024 Understanding the Net Investment Tax Chart Ultimate Tax Return For Investment Income net investment income is income received from assets (before taxes) including bonds, stocks, mutual funds, loans, and. how much tax you pay on your investment capital and income in spain is determined by your circumstances and the structure of your assets. Including savings interest, savings for children, tax on. how to fill in your tax return (2022). Tax Return For Investment Income.